If you are an employee, employer, or consumer in Ireland, it is important to understand the country’s tipping culture and recent legislative changes affecting tipping practices. One of the most significant changes is the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022, which came into effect on 1 December 2022.

To comply with the new legislation, employers are required to have a “Tips & Gratuities Policy” in place that outlines how tips and gratuities are distributed among employees amongst other requirements. Employers are required to ensure that this policy is accessible to both employees and customers. Additionally, they must prominently display a “Tips & Gratuities Notice” on their premises. Non-compliance with these obligations may lead to fines and other repercussions.

This article offers a comprehensive guide designed for employees, employers, and consumers in Ireland, delving into the new requirements of the gratuities policy and their effects.

If you work in Ireland’s hospitality sector, whether as an employer or employee, you might be aware of the recent updates in the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022. To grasp the importance of these updates, let’s take a quick look at the history of tipping laws in Ireland and how tipping was previously handled.

Before the introduction of the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022, there were no clear regulations on how tips and gratuities should be distributed among employees.

There was also no requirement for employers to declare what their tipping policy was. This may have led to the use of the classic tip jar but with no formal policy in how they were distributed between staff.

Previously, it was possible that the business was taking a share of the tips.

With the advancement of technology and cashless payments, tips were being collected by the business where the employees had no insight as to how much was being collected and what they were due.

This made it difficult for employees to know how much they were entitled to. Additionally, there was no legal obligation for employers to distribute tips and gratuities fairly among all employees, which led to some employees receiving more than others.

The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 started on December 1st, 2022. It brought in new rules on how employers distribute tips, gratuities, and service charges among employees. Plus, it made it against the law for employers to use tips or gratuities to cover basic wages.

In Summary:

The goal of the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 is to clarify what tips, gratuities, and service charges mean, keep tips and gratuities separate from contractual wages, and require employers to prominently show their policy for distributing both cash and card tips.

By having a clear and fair gratuities policy in place, employers can help to build trust with their employees and ensure that they are complying with the law.

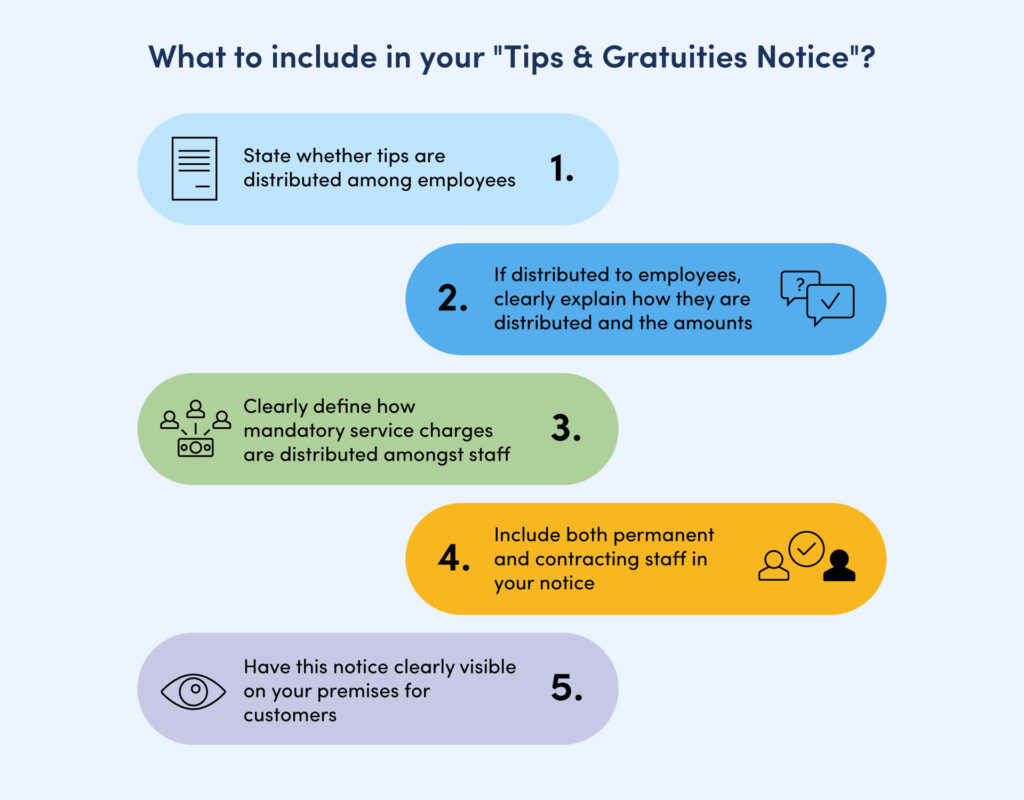

If you run a business that accepts tips and gratuities, you must have a clear policy in place for how these funds are collected, handled, and distributed among staff. The new policy requires that businesses provide transparency in how tips and gratuities are distributed to employees.

This is referred to as a “tips and gratuities notice”.

In section 4E of the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 it clearly states that:

(1) An employer to which this section applies shall display a notice (in this Act referred to as a ‘tips and gratuities notice’) stating:

This also applies to contract workers where the notice is referred to as a “contract worker tips and gratuities notice.“

In essence, your business must ensure that all tips and gratuities are collected and recorded accurately. This includes tips that are given in cash, on a credit or debit card, or through a service charge.

Your business must also ensure that all staff members are aware of the tips and gratuities policy and understand how tips and gratuities are distributed.

The law applies to industries where tipping is usual, like hospitality, tourism, hairdressing, taxis, and deliveries. It affects workers in places like restaurants, pubs, hotels, guesthouses, tour companies, beauty salons, and betting shops.

Employers should understand how the updated gratuities policy influences their business operations. These changes affect administrative, legal, and financial aspects. In this section, we will explore how these changes impact you as an employer.

As an employer, you are responsible for communicating the new gratuities policy to your employees and customers. You need to make sure that your employees understand the new policy and how it affects them. You should also communicate the changes to your customers, so they are aware of how their tips are being distributed.

To make sure you are following the rules, provide your employees with a detailed statement outlining the distribution of tips, gratuities, and service charges within 10 days of receiving them electronically. This promotes transparency for employees and helps them understand how tips are allocated.

Not following the new rules means the employer is breaking the law, which could lead to a class C fine upon conviction.

A summary offence is one that is handled by a judge without a jury, specifically in the District Court. According to the Fines Act 2010, since January 2011, summary convictions are subject to 5 categories or classes of maximum fines. If someone is found liable for a particular class of fine on summary conviction, the maximum fine for class, in this case, class C, is €2,500. Additionally, the court may choose to impose a term of imprisonment instead of or in addition to a fine.

Introducing a gratuities policy can greatly affect employees. Here, we will look into the possible advantages and criticisms of this policy, along with employees’ rights under it and how they can make sure these rights are upheld.

There are many potential benefits to having a transparent tips & gratuities notice:

However, there are also criticisms of the gratuities policy.

If you are an employee, knowing your rights under the new policy is key. You deserve a fair cut of tips and service charges, and your boss should be clear about how they’re divvying up those payments. If you feel like your rights aren’t being respected, you can file a complaint with the Workplace Relations Commission.

The business must display their tips & gratuities notice available for both customers and employees. You have the right to request this at any time.

Moreover, if you receive tips through an electronic payment method, you can request a detailed statement showing how tips and service charges were distributed within 10 days of receiving them.

As a customer, you may wonder how a gratuities policy affects you. Here are a few ways:

Knowing that a business has a clear policy on how tips and gratuities are shared can influence customers’ tipping decisions. If customers are confident that tips will be divided fairly among the staff, they might be more likely to leave a bigger tip. Conversely, if they are uncertain about how tips are split, they might not tip at all.

Even if they know a portion of the tips go to the business owner this may encourage customers to tip more. This is especially true of employers that run small businesses.

When it comes to gratuities policy, Ireland is not alone in having a complex set of rules and expectations around tipping. Let’s take a look at how other countries approach tipping laws and policies to provide you with a global perspective.

In the United States, tipping is an integral part of the service industry, with many workers relying on tips for a significant portion of their income. It is customary to tip between 15% and 20% of the total bill at restaurants, hairdressers, and other service-based businesses. However, there is no federal law mandating tipping, and individual states have varying laws regarding minimum wage and tipping.

In the United Kingdom, tipping is not as widespread as in the United States. It is customary to tip between 10% and 15% at restaurants, but this is not a hard-and-fast rule. Many restaurants include a service charge in the bill, which can be anywhere from 10% to 15%, and this is usually distributed among the staff.

In Australia, tipping is not as common as in other countries, and it is not expected in most situations. However, if you receive exceptional service, it is customary to leave a small tip of around 10% of the total bill.

In Japan, tipping is not part of the culture, and it is considered rude to leave a tip. Instead, the focus is on providing excellent service as part of the job, and workers are paid a fair wage without relying on tips.

In China, tipping is not common, and it is not expected in most situations. However, in recent years, some trendy restaurants in China have started to accept tips, so it is worth checking with the staff if you are unsure.

Tipping practices and policies differ greatly around the globe. When travelling, it is crucial to know the local customs. However, it is equally important to understand that tipping is up to you — it is a personal decision, and there is no one-size-fits-all approach.

As tipping customs evolve worldwide, it is essential to stay informed about local practices while recognizing tipping as a personal choice. Explore the nuances of gratuities policy and navigate their impact on various stakeholders with this insightful article.