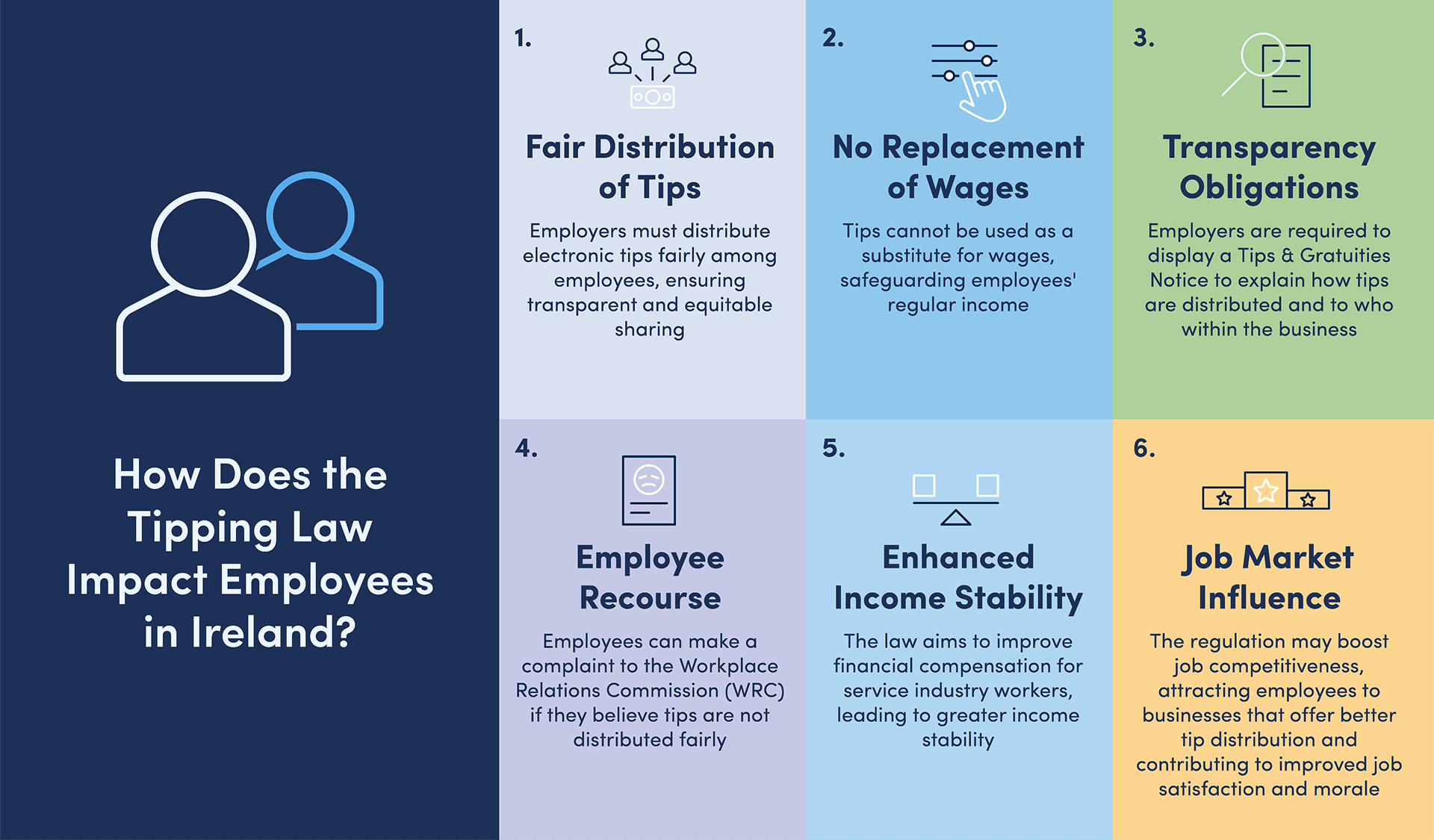

Explore how the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 is transforming employee compensation in Ireland. Centred on equitable tip allocation, this law seeks to fortify financial security for hospitality workers. Specifically, it mandates transparent sharing of electronic tips by employers, curbing their ability to replace wages with tips. This pivotal change not only fosters competition in the job market but also enhances income fairness for employees.

If you are in Ireland’s service industry, it is crucial to grasp the country’s tipping regulations. Tipping is common in Ireland, but clarity was lacking on how much belongs to staff. The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022, effective since December 1, 2022, aims to clear up tipping rules and ensure fair tip distribution to employees.

The new law defines a “tip or gratuity” as a voluntary payment made by a customer to, or left for, an employee or group of employees which they intended.

The law requires employers to:

It is important to note that the new law does not make tipping mandatory in Ireland. Tipping is still a voluntary act, and customers are free to decide whether or not to leave a tip. However, if a customer does leave a tip, the employer must ensure that it is distributed fairly among employees.

The tipping law impacts the financial stability of employees in Ireland as well as improving legal recourse. The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 has given employees in the hospitality sector legal rights over the payment of tips. This has brought about significant changes in how employees supplement their income with tips.

The new tipping law in Ireland brings much-needed clarity to how tips are distributed among staff, leading to greater income stability. Employers are now prohibited from using tips to supplement basic wages, ensuring more equitable compensation for employees.

Electronic tips must be shared among staff to avoid confusion and ensure fairness. This is important as there is less transparency over where tips are distributed as businesses may lose track over multiple transactions in a day.

If we consider the daily multiple transactions over a year then it is easy to imagine how the right proportion of tips due to staff may get lost. This is especially true as the employees do not have oversight of the transactions made by card payments to the business.

Employers must prominently display their tipping policy, accessible to both customers and staff upon request. They can take a fair share of tips if they perform similar tasks as employees and to cover transaction costs, as outlined in the Tips & Gratuities notice.

Overall, this new law significantly impacts income and financial stability, benefiting employees in the hospitality sector and beyond.

As an employee in Ireland, you have certain rights and protections when it comes to receiving and retaining tips.

Service charges, including mandatory service charges, should be distributed among staff.

When added to a bill, service charges reflect the level of service provided and can be voluntary or mandatory. The tipping law states that both types of charges must be treated equally, regardless of whether they’re paid electronically or in cash, as specified in section 4D of the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022.

If an employer covered by this section:

It is important to note that the same fair distribution of tips can be allocated to the employer based on their fair share of work in providing the service as well as a fair share cost in processing the payment.

If you believe that your employer is not complying with the new tipping law or is unfairly distributing tips, you have legal recourse. You can make a complaint to the Workplace Relations Commission (WRC), which is responsible for enforcing employment rights in Ireland. The WRC can investigate your complaint and take action against your employer if necessary.

If the employer is found to bypass the law, they are committing an offence and may face a Class C fine.

In case of a dispute over fairness, an adjudicator is appointed, who considers various factors.

In disputes over fairness, an adjudicator will consider various factors, including:

Overall, the new tipping law aims to protect your rights as an employee and ensure that you are fairly compensated for your work. If you have any concerns about how tips are being distributed in your workplace, you should speak to your employer or make a complaint to the WRC.

To help with the fair distribution of tips, a tronc system can be implemented with a troncmaster.

Implementing a Tronc system involves appointing a troncmaster, who represents the staff and cannot be the employer or involved in the hiring process. This troncmaster then oversees the equitable distribution of tips based on a predetermined formula.

Along with the set of laws discussed above, there are some obligations your employer is required to provide under the tipping law. The two main obligations are the Tips & Gratuities Notice as well as a transparent breakdown of gratuities made.

Under the new law, your employer is required to give employees a written statement within 10 days of the date of distribution on which the tip is made outlining:

Another requirement of the new tipping law is that your employer must be transparent with their customers about how tips, gratuities, and service charges will be distributed among employees.

This means that you must clearly display your policy on tips and service charges, so that customers know how their tips will be distributed. This policy is called a “Tips & Gratuities Notice”.

The Tips & Gratuities Notice should cover:

If the notice is not easily accessible or prominently displayed for customers, the employer is in violation and could face a Class C fine of up to €2,500, as well as potential imprisonment.

In Ireland, tipping is a common practice in the service industry, and it is customary to leave a gratuity for good service. However, the cultural attitudes towards tipping can be complex and vary depending on the region, the establishment, and the customer’s perception.

Prior to the implementation of the new tipping law, it was typical for customers to leave gratuities ranging from 10% to 15% of the overall bill in restaurants, cafes, and bars.

Nevertheless, there was no uniform procedure, and certain customers might have left minimal amounts or none at all. Furthermore, certain establishments could include a compulsory service charge on the bill, which might or might not have been distributed to the staff.

With the enactment of the new law, customers now have clearer insight into the destination of their gratuities and can be confident that their contribution is directly benefiting the staff.

Irish customers have high expectations when it comes to service, and they expect friendly and attentive staff. Some customers may not be aware of the new tipping law or may not understand the implications of the law. This lack of awareness may lead to confusion and misunderstandings between customers and staff.

The new tipping law provides greater transparency and confidence to the customer as to where the tips are distributed. This may lead to a greater amount of tips generated for staff for the service provided.

Furthermore, this might also motivate staff to offer better service when they understand that their efforts will directly influence a just distribution of tips, thereby augmenting their income as per the new law.

The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 has significant implications for employees in the hospitality and service industries. Here are some sector-specific effects of the tipping law:

The hospitality industry is one of the most affected sectors by the tipping law. The law covers service areas where tipping is common, including restaurants, pubs, hotels, and guesthouses [1]. As an established industry in handling tips, the primary challenge lies in ensuring that both employers and employees comprehend their rights and responsibilities to establish a fair and transparent system. This system should minimise the adverse impact on both businesses and employees.

The increased requirements on businesses will incur costs as well as additional admin to record tip transactions which are subject to tax. This plus determining and correctly allocating employees’ income will be an increased strain on businesses.

The service industry, including hairdressing, taxi, and delivery services, is also affected by the tipping law [1]. The law also applies to employees in beauty salons, tour companies, and bookmakers [1]. The main challenge for this industry is the lack of use of electronic payment methods. Since the law is focused around tips made from the use of electronic forms of payment, tips handed out by cash is largely unregulated as it is difficult to track and the tip may not come under any interaction or management of the business.

The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 may bring significant changes to the job market in Ireland over the long term.

The new law requires employers to share tips and gratuities with their staff. This may lead to a boost in job competitiveness since workers are now inclined to pick employers offering greater financial compensation including tips. Employers offering superior tips are also more likely to attract and keep skilled employees.

Additionally, in the long term there may be more competition for hospitality and serviced based work roles from other countries seeking employment in Ireland. This may occur as Ireland is seen as a more attractive job market for employees in other countries who do not have an established tipping law.

There may also be increased requests to how tips are distributed to all staff working within the business. This may include backroom staff e.g. kitchen staff that may demand a proportion of the total tips. This may be a change to the custom norm that only staff that work directly with customers e.g. waiting staff, have historically earned the entirety of the tips.

Overall, the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 has had a significant impact on the job market in Ireland. The act has led to increased competitiveness and transparency in the job market, which has improved job satisfaction and morale among employees.

The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022 in Ireland mandates fair tip distribution among employees, enhancing their financial compensation. Employers are obligated to share electronic tips and disclose tip policies, but tips can’t substitute wages. Employees can report unfair distribution to the Workplace Relations Commission, fostering job market competition and transparency.