Cashless tipping is a payment method that enables customers to leave tips using digital methods without using cash. This digital method is popular in the hospitality industry as a solution to reward staff for good service when customers pay without cash.

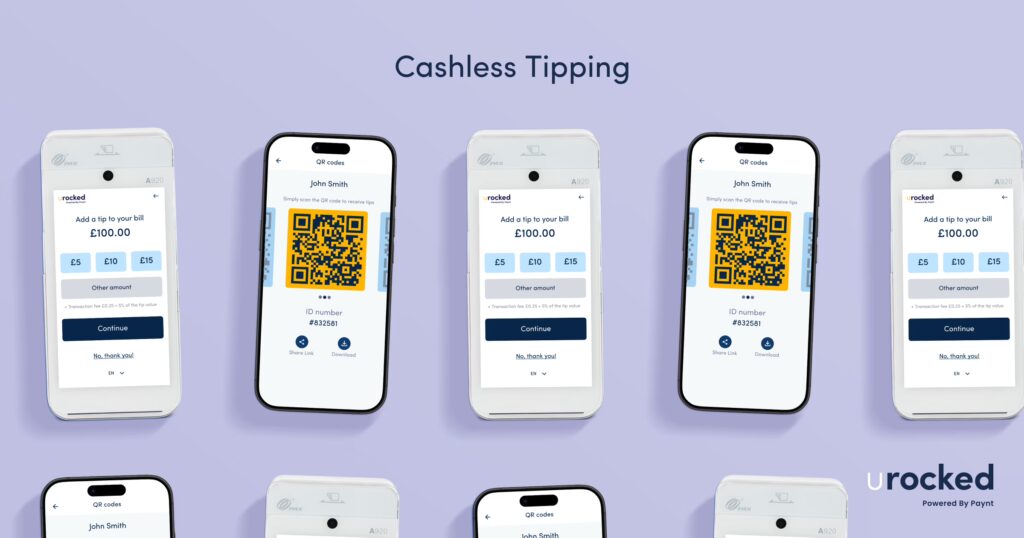

Cashless tipping works by enabling customers to initiate tips through digital interfaces including QR code scanning, card machines or mobile applications during transactions. This method of tipping offers convenience, transparency, and simpler administration for customers, staff, and businesses.

Cashless tipping is well suited for hospitality businesses, service staff, and customer-facing industries where traditional cash tips are becoming less common. Restaurants, cafés, bars, hotels, salons, and delivery staff can benefit most, as it offers a convenient, and transparent way to collect and distribute tips.

Cashless tipping, also known as digital tipping, is a payment method that enables customers to leave tips to reward good service using digital methods without using cash. A cashless tipping platform provides a fast, simple way to tip staff instantly and straight to employees bank accounts. This digital method removes the manual calculation and distribution of cash tips for customers, business and staff. Cashless tipping uses multiple payment methods such as debit and credit cards, digital wallets with Apple Pay and Google Pay and direct bank transfers to facilitate digital tips.

There are different types of cashless tipping including QR codes, online web platforms, POS card tipping terminals, digital payment apps and bank transfers. These digital tipping methods are entirely contactless and provide a hygienic option for customers to send tips to service workers.

Using a cashless tipping platform provides transparent records of tip transactions for both workers and employers. With detailed records of tips, workers and management save time on admin and reporting for tax purposes. Cashless tipping platforms are typically compliant with tipping laws such as the Employment (Allocation of Tips) Act 2023 in the UK.

In the hospitality industry, a cashless tipping system can be integrated with existing point-of-sale systems. Cashless tipping provides additional convenience for customers and businesses as it allows customers to leave digital tips in the same transaction with the bill.

Cashless tipping has become popular in the hospitality industry where tipping is customary due to the rise in digital payments. In 2023, 19.9% of purchases were made with cash in the UK outlined in the Payments Survey 2024 conducted by the British Retail Consortium. Cashless tipping enables staff to be rewarded for good service in instances where customers do not carry cash.

A cashless tipping app is a digital service that enables customers to give digital tips to service staff using mobile applications. These applications allow customers to leave tips using mobile wallets and direct bank transfers without using physical cash. Cashless tipping apps are purpose-built for gratuity transactions in hospitality, retail, and service industries such as restaurants, hotels, and cafés. Cashless tipping apps provide features such as detailed tip transactions, analytics and reporting and branding options unlike simple static QR codes. Businesses and staff have oversight of the amount of tips received and the scheduled payout of tips.

These applications feature multiple payment methods including direct bank transfers, digital wallets, and debit or credit cards. With a cashless tipping app, service staff create individual profiles, generate unique QR codes, branded QR codes and display these at their workstation.

Cashless tipping works by using digital technology such as QR code scanning, card machines, online platforms or mobile applications to enable customers to leave a tip by card or digital wallet. Customers choose the tip amount and send cashless tips directly to individual staff or a central tip pool. Cashless tipping with QR codes starts when customers scan encrypted payment URLs using their smartphone camera to open the tipping platform. On payment terminals customers are prompted to enter tip amounts on the payment terminal screen typically as part of the overall payment. On mobile applications such as food-delivery apps, users add tips with their payment for goods and services using the app interface.

Once the customer confirms the payment, the payment gateway securely transmits the tip details such as amount, merchant, card details, or wallet token to the acquiring bank. The transaction details are forwarded through the card network to the issuing bank. The issuing bank verifies funds, performs fraud checks, and authorises the transaction.

After authorisation, the movement of funds for settlement takes place between banks. The payment gateway then compiles approved tips and submits them for clearing within a couple of days. The card network clears transactions and directs issuing banks to transfer funds to the acquiring bank. Through the card network’s settlement system, the issuing bank sends the tip amount to the acquiring bank, which credits the merchant’s account.

The system logs the completed transaction and sends confirmation to the customer and business. After payment confirmation, tips go directly to the employee or into a central pool, where they are allocated by a set formula under the business tip policy.

Cashless Tipping with URocked works by separating tips from business transactions using a combination of card machines, mobile apps, software, NFC technology, and QR codes to ensure staff receive their fair share of tips. URocked creates a cashless tipping ecosystem between customers, workers, and businesses that provides ease and convenience from the point of tipping for customers and staff. The tipping platform provides transparency and easy management through business dashboards and mobile apps for workers.

The process begins when customers scan URocked’s QR codes displayed on the Members Tipping App, pay on dedicated Quick Tips NFC enabled devices or integrated card machines that offer ‘pay at table’ experiences.

The payment process treats tips as separate transactions from the main bill using URocked’s technology processes each tip through independent digital channels. URocked’s technology processes the tip payment through secure digital channels that connect directly to the staff member’s accounts.

This process ensures complete separation from business revenue. The tipping funds never enter the business’s bank account or payroll system. The system automatically routes 100% of customer tips directly to the designated staff member’s URocked account. Staff members access and manage their tips through the URocked Members App. The app provides real-time visibility of tip earnings, transaction history, and payment schedules.

Cashless tipping is secure because it employs multiple layers of digital protection such as tokenisation, encryption, and Payment Card Industry compliance standards. Tokenisation replaces sensitive card details with encrypted tokens because this process prevents data exposure during transactions. Actual payment information never reaches the recipient with tokens acting as substitutes for real data in the system. End-to-end encryption protects data transmission between the customer’s device, payment processors, and banking networks.

Contactless payments eliminate the risk of physical theft and provide complete transaction audit trails in digital formats. Payment Card Industry compliance standards govern cashless tipping platforms. These standards require rigorous security protocols that protect cardholder data throughout the entire process.

Cash handling for businesses involves manual counting leading to physical storage risks and risk of theft during transport. Whilst cashless tipping is secure, no system is completely foolproof due to vulnerabilities depending on security of each individual service provider.

The privacy features of cashless tipping are listed below:

1. Anonymises customer identity: Staff members are prevented from viewing personal details of customers who provide tips through the application.

2. Minimises data collection: Essential information required is collected for payment processing. No additional information is collected reducing exposure risks during potential data breaches.

3. Tokenises payment information: Tokenisation replaces card details with secure tokens, making transactions unlinkable to customer identities during processing.

4. Stores data securely: Encrypted databases protect personal and transactional information from unauthorised access or cyber attacks.

5. Complies with regulations: Cashless tipping typically complies with regulations including General Data Protection Regulation (GDPR), Data Protection Act 2018, and Payment Card Industry standards for legal compliance.

6. Prevents customer-staff data sharing: Cashless tipping software ensures payment details, names, and contact information remain hidden from individual staff members receiving tips.

7. Provides confidential earning reports: Secure, password-protected portals with encrypted transmission protocols that protect staff income details from unauthorised viewing.

The advantages of cashless tipping include enhanced convenience, improved security, increased transparency, and streamlined administrative processes that benefit customers, service staff, and businesses through digital payment integration and automated systems. The advantages of cashless tipping are listed below:

Listed below are the disadvantages of cashless tipping:

The best cashless tipping app is URocked’s mobile tipping solution which provides an easy-to-use and instant digital tip system for customers and comprehensive management tools for businesses. URocked’s cashless tipping app enables customers to tip staff directly through QR codes, NFC technology, and mobile payment integration without requiring cash. Tips are automatically collected, calculated, and fairly distributed to staff according to business tip policies, reducing administrative burden for management whilst ensuring legal compliance.

Staff tips are allocated instantly, trackable through the URocked Members App, and paid out every Monday, Wednesday, and Friday, improving financial transparency. URocked’s cashless tipping app complies with the Employment (Allocation of Tips) Act 2023, ensuring businesses meet UK tipping legislation requirements.

For businesses, URocked’s cashless tipping app provides transparent oversight and ensures staff receive tips in full and on time through digital management systems. Management monitor total tip amounts and track correct allocation to eligible staff members through URocked’s detailed reporting dashboard accessible via web browser or mobile device.

For customers, URocked’s cashless tipping app makes tipping simple and transparent through multiple digital payment methods and user-friendly interfaces. The app displays clear tip amounts and confirmation messages, ensuring customers know exactly how much they are tipping and which staff member receives the gratuity.

Yes, URocked’s cashless tipping system complies with the Employment (Allocation of Tips) Act 2023. The platform separates tips from bill payments and transfers 100% of gratuities directly to staff members in compliance with the tipping act. Tip transactions are collected and distributed every Monday, Wednesday and Friday for timely payments in accordance with the act. Tip transactions are available on the members tipping app and available on request for reporting in compliance with the act.

The best cashless tipping platform in restaurants is URocked’s digital tipping solution which enables restaurant customers to tip staff directly through POS terminals, QR codes, mobile apps, and integrated payment systems in one seamless transaction. Customers can tip using Apple Pay, Google Pay, NFC-enabled cards, and mobile banking apps through QR code scanning and NFC technology whilst ensuring legal compliance with the Employment (Allocation of Tips) Act 2023.

URocked automatically distributes tips fairly to eligible restaurant staff according to the establishment’s tip policy, provides detailed reporting for payroll and tax obligations, simplifying restaurant management operations.

The cashless tipping platform offers complete oversight of tip collection and allocation through an easy-to-navigate dashboard accessible on mobile devices and computers. The system ensures restaurant staff receive their tips in full and on time whilst reducing administrative burden.

The best cashless tipping platform in hotels is URocked’s digital tipping solution which enables hotel guests to tip hotel service staff directly through card machines, QR codes and mobile apps without requiring cash. Hotel guests can tip using Apple Pay, Google Pay, NFC-enabled cards, and mobile banking apps. The system is legally compliant with the Employment (Allocation of Tips) Act 2023. URocked automatically distributes tips fairly to eligible hotel staff across multiple departments according to the hotel’s tip allocation policy.

URocked provides detailed reporting for payroll and tax obligations, simplifying multi-department tip management. The cashless tipping platform offers complete oversight of tip collection and allocation across housekeeping, front desk, concierge, and restaurant teams through an easy-to-navigate dashboard accessible on mobile devices and computers.

The system ensures hotel staff receive their tips in full and on time whilst eliminating the complexity of managing tips across different hotel departments.

Yes, you can use cashless tipping in a franchise system using digital tipping platforms like URocked which are designed to integrate with multiple business locations whilst maintaining centralised management and compliance standards. The URocked platform enables staff to work and earn cashless tips across multiple locations within the franchise. Staff using the URocked app will automatically earn a fair share of tips they contributed to at each location. Franchise owners can monitor tip collection and distribution across all locations through unified reporting dashboards that provide real-time visibility of staff earnings and customer tipping patterns.