Under Ireland’s tipping law, employees have rights ensuring their tips are not used to supplement wages and are fairly distributed. The Workplace Relations Commission (WRC) enforces these rights, while business owners must comply with regulations to maintain transparency and fairness. Ireland’s tipping system differs from the UK and USA, with unique legal frameworks and cultural expectations.

The tipping law in Ireland was updated with the introduction of The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022. This act protects employee rights by setting clear rules on tip distribution and requiring transparency regarding tips and gratuities for both staff and the business, as well as for customers.

The tipping law encompasses all sectors where tipping is customary, notably hospitality and service industries, to ensure fair and transparent treatment of tips and gratuities amongst workers.

(a) services provided under a public transport services license,

(b) services provided under a public bus passenger service license,

(c) services exclusively for transporting children to and from school.

The tipping law in Ireland has now set clear guidelines on how tips and gratuities are distributed. There are a few key elements that employer, staff and the general public should know:

According to the tipping law, tipping electronically, such as using a debit or credit card, the tip must be fairly shared among employees. They cannot be counted as part of their regular or contractual wages, and employers have to distribute them in a way that is clearly communicated to customers.

Any service charge added to a customer’s bill (including mandatory charges) must be given to the employees. This rule covers all payments, whether they are made electronically or by other methods.

Businesses are prohibited from using the tips to make up an employee’s basic wage. However, businesses may take a fair share of tips based on the following conditions:

According to the information provided, businesses, especially owner-operated ones, need to determine what proportion of tips they are entitled to.

The legislation applies to all workers, including those under contract and part-time employment within the service industry. The law treats all types of employment equally, ensuring that all staff who receive tips are protected.

If a business fails to comply with the tipping law, they face potential legal repercussions.

If an owner unlawfully takes tips meant for employees, they will be charged with an offence and could face a class C fine on summary conviction.

A summary offense is one that is handled by a judge without a jury, specifically in the District Court.

According to the Fines Act 2010, since January 2011, summary convictions are subject to 5 categories or classes of maximum fines. If someone is found liable for a particular class of fine on summary conviction, the maximum fine for class, in this case, class C, is €2,500. Additionally, the court may choose to impose a term of imprisonment instead of or in addition to a fine.

Cash tips are not currently regulated and not explicitly mentioned in the Act. This is because cash left voluntarily is hard to trace and may never be handled or under the possession of the employer.

This makes it difficult to take enforcement actions. On the other hand, when tips and gratuities are paid by electronic forms, the employer has control over their distribution, unlike cash tips given directly to the worker.

However, an employer should include how cash tips are treated in their ‘Tips & Gratuities Notice’.

In Ireland, employees’ rights regarding tips and gratuities are safeguarded by the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022. This legislation ensures staff entitlement to any tips given directly to staff, or meant for staff, by customers.

Key aspects of your rights:

To protect these rights, the Act imposes strict guidelines on employers:

The Workplace Relations Commission is available to employees for enforcing these rights if any disputes arise. If employees believe their rights are being infringed upon, they are encouraged to seek assistance from the relevant authorities.

The Tipping Law in Ireland sets specific requirements that employers must follow regarding the treatment of tips and gratuities. It ensures transparency and fairness for employees.

Businesses are required to display a ‘Tips & Gratuities Notice’ prominently that clearly outlines the policy on how tips and gratuities are distributed. This notice should be easily visible to both staff and customers, ensuring there is no ambiguity about the handling of tips.

What should be included in the notice:

(a) Whether tips or gratuities are distributed to employees and among them.

(b) If tips or gratuities are distributed to employees, the method and amounts of distribution.

(c) If mandatory charges, or any part of them, are distributed to employees, how they are distributed and the amounts involved.

This notice also applies to contract workers and should explain how tips are distributed and how much.

It is important to outline separate payments to wages in your payment records. Tips and gratuities should not form any part of basic contractual pay rates. Businesses should record and distribute electronic tips and gratuities separately and in a fair and equitable manner, as stated by the Workplace Relations Commission.

Compliance with these obligations will not only ensure that the law is upheld but will also aid in maintaining a trustworthy relationship with employees. It is essential to operate with a level of openness regarding tips, supporting a positive work environment.

Employers must provide a written summary detailing the amount of tips received and how they are shared out among staff. This summary should be provided within 10 days of the distribution of tips summarising the total amount of tips distributed by the employer and the amount distributed to the employee.

The introduction of the tipping law in Ireland has reshaped financial practices within the hospitality sector. It particularly influences taxation responsibilities for both employers and staff.

The tipping law can impact the amount of tax an employer pays, especially VAT.

Ensuring proper processing of payments should lead to reduced taxation. Keeping transactions separate between employer and staff could result in a lower VAT charge for the business. This separation prevents VAT from being applied to a single transaction encompassing the business bill and the tip or service charge, as was previously the case.

The tipping law directly affects employee taxes. Cash tips are not passed through the business’s payroll but additional income like cash tips are subject to tax.

Non-cash tips and service charges now go through payroll, meaning they are subject to deductions like PAYE (Pay As You Earn), PRSI (Pay Related Social Insurance), and USC (Universal Social Charge). Employees should be provided with a summary detailing the amount earn from their wage and the amount paid in addition from the distribution of tips.

In Ireland, the Workplace Relations Commission (WRC) is primarily responsible for enforcing the tipping law outlined in the Payment of Wages (Amendment) (Tips and Gratuities) Act 2022. The WRC oversees compliance with this legislation and handles inspections and complaints regarding employment rights, including issues related to tips and service charges.

Your responsibilities as an employer:

Challenges you might face:

What steps are involved in handling a complaint?

Key elements for compliance:

Understanding and adhering to the regulated structures will help mitigate any potential compliance challenges. Stay informed of your obligations to maintain a lawful and equitable workplace.

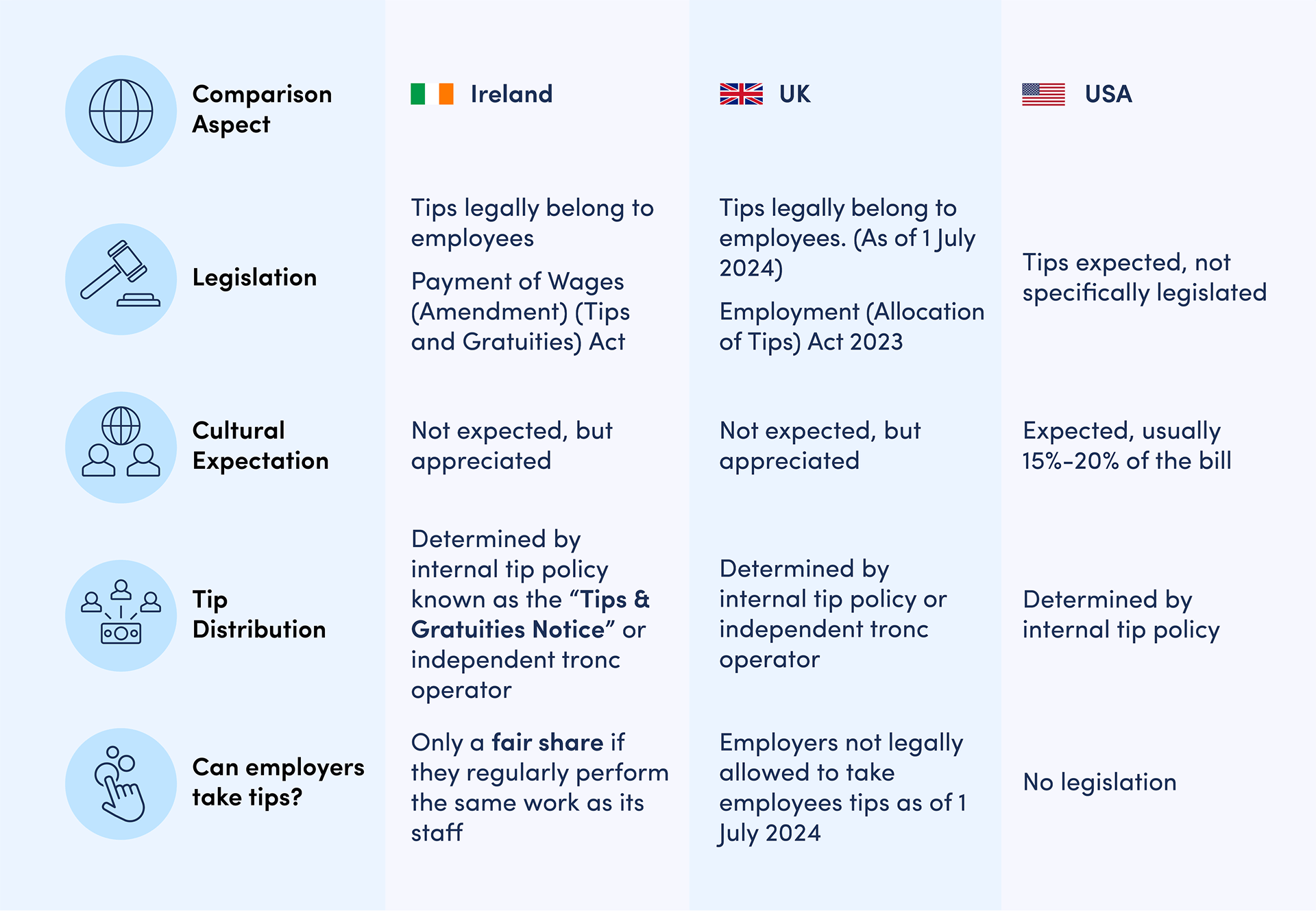

The tipping law in Ireland contrasts with practices in the UK and USA. Ireland’s tipping system is now clearly legislated, whereas the UK has a more voluntary approach. In the UK the legislation will change on the 1st of July 2024 with the introduction of the Employment (Allocation of Tips) Act 2023 which will improve employees rights to tips comparable to Irish legislation. The legislation in Ireland ensures that gratuities and tips go directly to the employees rather than the employers.

Unlike the USA, where tipping is deeply ingrained in the service culture and expected amounts range from 15% to 20% of the bill, Ireland’s law safeguards the tip amount for the worker without specifying a mandatory percentage.

Here is a brief comparison:

In the USA, workers often depend heavily on tips as a big part of their income, whereas in Ireland, tips are extra on top of the employee’s wage, offering more stability in income.