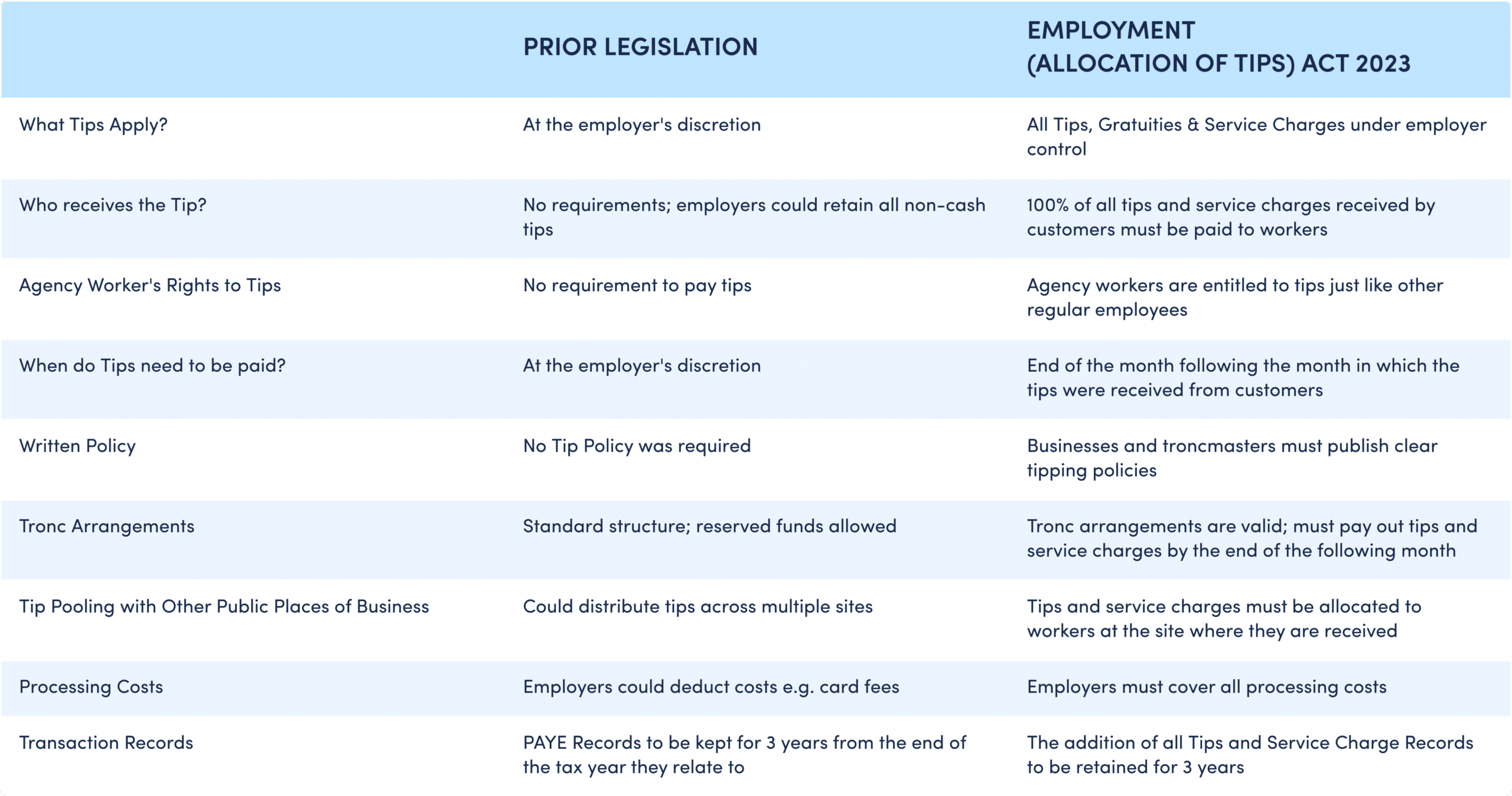

The Employment Allocation of Tips Act 2023 introduces key regulations into law to ensure that tips, gratuities, and service charges are fairly distributed among all workers involved in delivering customer service which may include non-service staff. The Act was passed by the UK Parliament in May 2023 and officially came into effect on October 1, 2024.

The Act covers all qualifying tips, which include employer-received and worker-received tips, as well as mandatory and discretionary service charges. Qualifying tips include any gratuity given by a customer, whether directly to the worker or processed through the employer, excluding any portion that accounts for VAT. The Act requires that these tips be distributed fairly, using clear criteria such as the worker’s role, hours worked, and seniority in accordance with the code of practice by the Secretary of State.

Contents:

1. What Tips Apply Under the Act?

2. Which Workers are Entitled to the Fair Allocation of Tips?

3. Can Tips be Shared within different Locations of a Business?

4. When do Tips need to be Paid to Staff?

5. What are the Record-Keeping Requirements under the Act?

6. Creating a Written Tip Policy

7. What are the rights of Workers under the act?

8. Are the use of Troncs permitted under the act?

Overview of new tipping law in the UK

The new Act brings about large changes in how tips are allocated and recorded and as a result questions arise on what to know about the new act as waiter, a restaurant owner and as a customer. In this article we will outline what tips apply under the act, which workers are entitled to tips, when tips are required to be paid and record keeping requirements, written policy requirements and the use of independent tronc operators.

“Qualifying tips, gratuities and service charges” apply under the Employment (allocation of tips) Act outlined in section 27C (2). These are all tips, gratuities, and service charges paid by the customer of the employer either as a worker-received tip or employer-received tip. Both types contribute to the total qualifying tips generated at a place of business.

A qualifying tip, gratuity or service charge can be an amount not paid in money such as a form of voucher, stamp or token.

“Qualifying tips, gratuities, and service charges” as defined in Section 27C(2) of the Act are categorised as either employer-received tips or worker-received tips that are either subject to employer control or connected to other worker-received tips under employer control.

Employer-received tip

An Employer-received tip is any tip, gratuity, or service charge paid by a customer that is received directly by the employer, an associated person, or through an arrangement made between the employer and another person.

Employer-received tip example: A customer includes a tip within their credit card payment, the amount is processed by the employer. The employer then allocates the collected tips among the staff based on predetermined policies or systems, such as a pooled tip arrangement according to their tip policy.

Worker-received tip

A Worker-received tip is any tip paid by a customer that is received directly by a worker and is not later received by the employer or an associated person.

Worker-received tip example: Customers hand a tip directly to the employee, often as a thank-you for good service. To be considered qualifying tips, the employer must have policies in place that regulate how these tips are handled. This could involve employees pooling their tips or sharing them with other staff members, such as kitchen staff.

This ensures that both employer-handled tips and worker-received tips influenced by the employer are covered by the Act.

The full amount of the tip is the total amount given by the customer as a tip, gratuity, or service charge that is not contributing to paying the bill, VAT or any deductions as outlined in section 27C (6). This means that when calculating the total amount of tips, any deductions (such as administration fees or processing costs) made by the employer or any other party should be disregarded. The focus is on the original amount paid by the customer less any statutory taxes.

Exclusion of VAT: If the amount paid by the customer includes value added tax (VAT), the portion of the payment that represents VAT is excluded from being considered a tip, gratuity, or service charge. Essentially, only the amount after VAT is counted as part of the tips or service charge that is to be fairly distributed to the workers.

Yes, mandatory service charges, which is an additional payment on top of the cost of specific goods or services that customers are required to pay, are qualifying service charges under the Employment (Allocation of Tips) Act 2023.

Both mandatory and discretionary service charges, like tips and gratuities are to be allocated fairly to workers without deductions.

The Act states that all service charges are considered qualifying service charges, even if labeled differently. This prevents employers from rebranding service charges as “supplemental charges” to avoid giving staff their tips.

All workers who undertake work or services personally for another party under a contract, either of employment or another agreement are entitled to fair allocation of tips. This includes not only traditional employees but also workers with different kinds of agreements, such as part-time, casual, or agency workers.

In essence, anyone who contributes to the service provided to customers, whether front-of-house staff like waiters or back-of-house staff such as kitchen workers, has the legal right to receive a fair portion of the tips, gratuities, or service charges generated at the business.

Yes, agency workers, individuals who work for a principal business through an arrangement between an agent and the principal, are entitled to tips under the law, outlined in section 27H.

Even though there is no direct employment relationship between the agency worker and the principal, the agency worker is treated as if they were a worker of the principal.

If the agency worker is entitled to tips, these tips may be paid directly to the agent instead of the worker, within the period specified in the Act. The employer is prohibited from making any unauthorised deductions from the amount of tips, whether they pay the tips to the worker directly or to the agent.

Yes, non-service staff (such as kitchen or back-of-house staff) are entitled to a fair allocation of tips under the Employment Allocation of Tips Act, as long as they contribute to the service provided. The Act requires that tips, gratuities, and service charges be allocated fairly among all workers who play a role in delivering the service to customers, not just those who interact directly with them.

Tips generated at one public place of business can only be shared with the staff who worked at that location and contributed to the service. Employers are required to ensure that the total amount of tips, gratuities, and service charges paid at or attributable to a specific place of business is allocated fairly between the workers at that location.

This means tips earned at a particular restaurant cannot be shared with employees at another restaurant, even if both are part of the same chain.

The definition of public place of business (section 27E (3)) is outlined below:

Public place of business: A place of business where interaction between customers and workers of the employer occurs mainly face-to-face.

If the tips originate at a non-public place of business, the employer has an obligation to ensure tips are allocated fairly among workers.

Employers can allocate tips fairly from a non-public place of business by:

The statutory Code of Practice outlines the key principles of fairness under the Tipping Act and offers guidance on how employers may apply these principles when developing and implementing a policy for handling tips.

The Key Factors for Fair Distribution from the Code of Practice include:

These factors allow employers to create a fair and reasonable allocation policy tailored to the specific needs of their business, as long as it is clearly communicated and consistently applied.

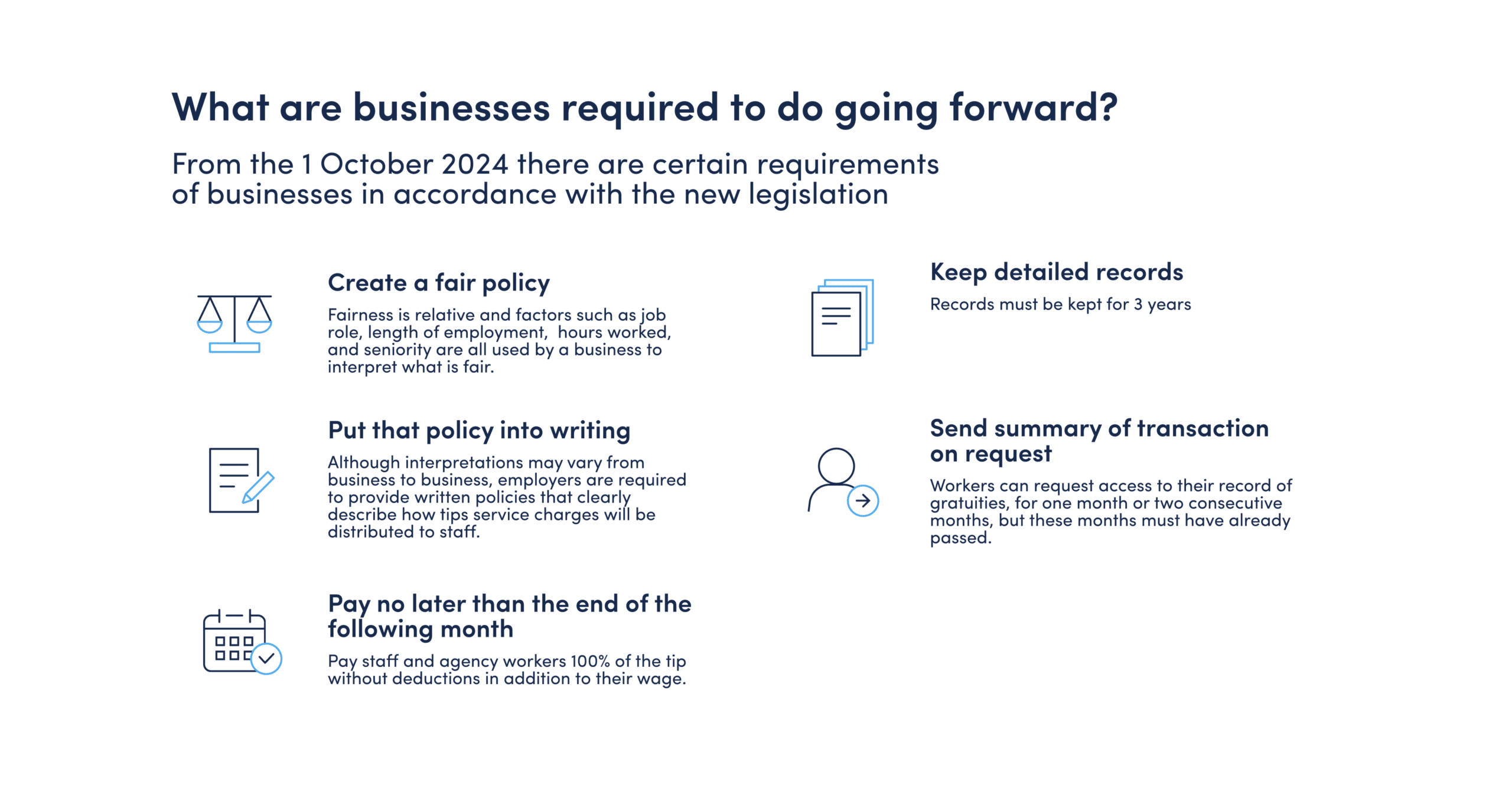

Payments of tips must be made no later than the end of the month following the month in which the tips were received from customers, outlined in section 27G of the Act. For example, if a tip is received on May 12th, it must be paid to the workers no later than June 30th.

How can businesses Implement Timely Tip Payments?

To ensure compliance with this requirement, businesses and restaurants can adopt the following practices:

Employers must keep records if qualifying tips are regularly paid at a place of business. This requirement applies if tips are received more than occasionally and exceptionally. Records must be maintained for three years as outlined in section 27J of the Act.

Details to Record

Employers need to maintain records of:

Worker Access to Records

Workers have the right to request specific parts of these records. They are entitled to submit a written request to access records on:

If the employer is required to maintain records, they must provide the worker with the requested records within four weeks or 28 days of the request defined as the “response period”.

Limitations on Workers Requests

Workers have limits on the number of requests made and how far back they may

Employers are required to have a written policy on dealing with tips, gratuities, and service charges for each place of business where these payments are made on a regular basis i.e. more than on an occasional or exceptional basis.

What is a Written Policy?

A written policy under the Employment Allocation of Tips Act is a formal document that employers are required to create explaining how qualifying tips, gratuities, and service charges are allocated outlined in section 27I. The written policy must be made available to all workers at the place of business.

There are two requirements businesses are required to include within their written policy outlined in Section 27I (2).

Employers are required to outline the following in their written policy:

Are you starting out and setting up your written policy on tips? Feel free to enter your email below and receive a free template where you can insert your company name as well as how you deal with cash and card tips and service charges.

The Employment Allocation of Tips Act outlines how workers can address issues related to the fair distribution and timely payment of tips. If an employer or agency fails to comply with the requirements for tip allocation or payment, workers can file a complaint with an employment tribunal. Workers have 12 months (or one year) to do so, though extensions may be granted in certain circumstances. Should the tribunal find the complaint valid, it can order the employer to revise tip distributions, issue recommendations, or require payments to affected workers.

Additionally, workers may be eligible for compensation of up to £5,000 if they can demonstrate financial loss due to improper handling of tips. This ensures workers are protected and have a legal avenue to seek corrective actions and compensation. This is outlined in section 27K, 27L and 27M of the Act.

Workers can file a complaint with an employment tribunal if their employer fails to ensure that all qualifying tips at a place of business are fairly allocated among the workers who contributed to earning them. Workers can file a complaint if tips are not distributed within the specified period; no later than the end of the month following the month in which the tips were received from customers.

Eligible Agency Workers

Those employed through an agency can also file a complaint if their agent (the agency) does not pay them the tips owed. The agency is obliged to pay the agency worker any tips that the principal (the business where they worked) paid to the agency. Essentially, the agency is responsible for passing on the tips to the worker once they receive them from the business.

An eligible agency worker can file a complaint under section about the agent’s failure to make payments, whether or not they are also filing a complaint about the employer’s failure.

Complaints must be filed within 12 months of the employer or agent’s failure to comply. However, if the worker can show that it was not reasonably practicable to file the complaint within the 12-month window, the tribunal may accept the complaint after the deadline, within a reasonable extended period.

If the tribunal finds that the employer or agent has indeed failed to comply with the tip allocation rules, the tribunal will issue a declaration confirming the breach. Following this, the tribunal can take several actions:

Importantly, a tribunal’s decision on one worker’s complaint does not prevent other workers from bringing similar complaints regarding the same tips or service charges, ensuring that all affected employees can seek justice.

The tribunal has the authority to award compensation for financial loss. If the worker suffered financial harm due to the employer’s or agent’s failure to properly allocate or pay tips, the tribunal can order compensation of up to £5,000.

This compensation is awarded regardless of whether the tribunal also orders a revision of tip allocations or payments. It is intended to directly compensate the worker for any loss of income that resulted from the employer’s non-compliance with the law, offering a financial remedy alongside the correction of tip distribution practices.

The Employment Allocation of Tips Act allows employers to use independent tronc operators to fairly distribute tips, gratuities, and service charges among workers outlined in section 27F. An independent tronc operator, acting separately from the employer, manages the allocation without unauthorised deductions. Employers are considered compliant with the law’s fairness requirements if they use such a system, provided it’s deemed fair under relevant codes of practice.

Fair Allocation of Tips using an Independent Tronc Operator

If an employer arranges for all or a part of the tips to be allocated to workers by an independent tronc operator and it is deemed fair, then the employer will have ensured that the tips are allocated fairly. This means that, as long as it is fair, the employer is considered compliant with the fair distribution requirements if an independent tronc system is in place.

Employer is not responsible for direct payment

When tips are allocated by an independent tronc operator, the employer is not responsible for paying the tips directly to the workers. Instead, the tronc operator is responsible for distributing the tips.

There are a number of key components of the Employment Allocation of Tips Act that a waiter should know.

Key components of the act a waiter should know include:

As a restaurant owner, the Employment Allocation of Tips Act sets out specific legal obligations you must follow when handling tips, gratuities, and service charges.

The key components of the Act that restaurant owners need to know:

Fair Allocation of Tips:

Written Tip Policy:

Timely Payment of Tips:

No Unauthorised Deductions:

Independent Tronc System:

Agency Workers:

Record-Keeping Requirements:

Complaints and Tribunal Action:

As a customer, the Employment Allocation of Tips Act ensures that the tips, gratuities, and service charges left at restaurants or other service establishments are fairly distributed among the staff.

Here’s what customers need to know about the Tip Act:

Tips are to be allocated to staff without deductions by the employer

Service Charges are treated in the same way as tips

You may request what the tipping policy is

What happens to Credit Card Tips

What happens to Cash Tips

Employers ensure fairness in distributing tips received through card machines by implementing a transparent allocation system based on factors like hours worked or roles. They are required to have a written tip policy outlining the distribution process, avoid unauthorised deductions, and ensure tips are paid to workers promptly. Employers must maintain records of tip allocations for transparency and compliance, and may use an independent tronc system to manage the fair distribution of tips. This ensures all workers involved in providing the service receive their fair share of the tips.

The increased use of card machines for tipping is likely to raise the administrative burden on employers due to several requirements under the Act:

Compliance with Payment Timelines: Card tips must be processed and distributed promptly to comply with the Act, requiring integration with payroll systems and timely payment cycles, which adds further administrative steps.

If you’re a business owner looking to streamline tipping in your establishment and comply with the latest tipping act, check out URocked’s innovative Payment Solutions. Our card machines simplify tipping for your customers by separating the bill from the tip to ensure compliance with UK gratuity laws. Learn more about URocked’s Tipping Solutions here!