If you work in the hospitality or service industry you may be curious about the etiquette and legality of tipping and you might be wondering how tips are supposed to be managed. Rules about tip sharing can depend largely on agreements set by employers and could vary from one workplace to another. Some restaurants might have a policy where all tips are pooled together and shared amongst staff, whereas others may allow waiters to keep the tips they earn.

Understanding the legal framework and norms around this topic is important for both customers and service workers to ensure fair practice.

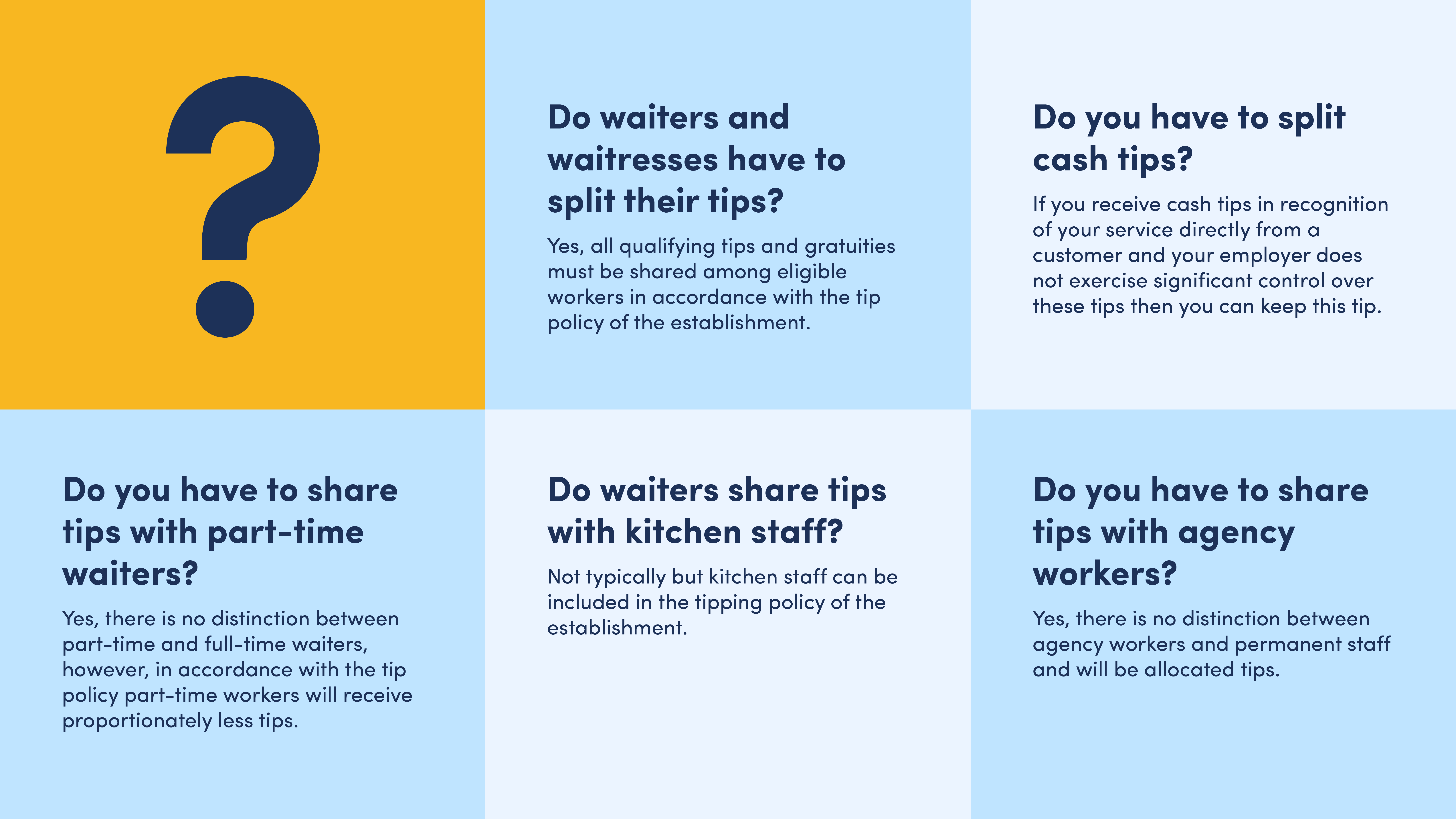

Tips in which you collect directly from the customer, such as cash tips, which your employer does not exercise significant control over do not need to be shared.

In short, yes, all qualifying tips and gratuities must be shared among eligible workers under the tip policy of the establishment. Understanding how these tips are defined and distributed is essential for both employees and customers.

A qualifying tip is any tip, gratuity or service charge paid by a customer that meets the criteria of an employer-received tips or worker-received tips. The sum of both employer-received tips and worker-received tips is the total qualifying tips, gratuity or service charge generated at a place of business.

Employer-received tips are those tips, gratuities, or service charges paid by a customer that are either received directly by the employer or processed through a third-party payment arrangement. These typically include tips added to a credit card or debit card bill. In this scenario, the employer handles the collection and subsequent distribution of the tips according to the establishment’s policy to its restaurant staff.

Worker-received tips are gratuities given directly to an employee by a customer, usually in the form of cash. For these tips to be considered qualifying, the employer must have a level of control or significant influence over their distribution. This control might involve policies that require the employee to share their tips with other eligible workers.

Examples of Distribution Methods:

Here is a simple breakdown of how tip splitting might work:

| Staff Member | Hours Worked | Share of Tips |

| Waiter A | 8 hours | 40% |

| Waiter B | 6 hours | 30% |

| Waiter C | 4 hours | 20% |

| Waiter D | 2 hours | 10% |

While you may feel that the tips are a direct result of your service, the principle behind tip pooling is to recognise the collective effort of all staff. If your restaurant has a tip pooling method, then yes, you are required to share your tips. Ensure you’re aware of the tip pooling and splitting rules at your place of work to understand how much of your tips you’re expected to share.

With the introduction of the Employment (Allocation of Tips) Act 2023, new regulations have been put in place to ensure that tips are distributed fairly among staff workers. This section explores the legal obligations of employers and workers regarding the sharing of tips.

Employers are required to ensure that 100% of the tips and gratuities earned by staff workers go directly to them, with no deductions allowed. Previously, tips and gratuities paid to the employer were considered the legal property of the employer. This legal change ensures that tips now go directly to the staff, providing them with their rightful earnings.

Key points regarding employer obligations include:

For workers, the obligation to share tips depends on the level of control exercised by the employer.

A qualifying tip is one where the employer exercises significant control over its distribution. This typically means that tips given to a waiter or waitress, even if received directly from a customer, must be shared according to the employer’s tip-sharing policy if the employer dictates how these tips should be allocated.

However, tips given directly to a worker, where the employer does not exercise significant control over their distribution, do not legally have to be shared. This allows workers to keep certain tips for themselves, provided they fall outside the employer’s control or significant influence.

By understanding these regulations, both employers and employees can ensure compliance with the law, promoting fairness and transparency in tip distribution within the hospitality industry.

Yes, according to the new Employment (Allocation of Tips) Act 2023, employers must have a written policy outlining whether they encourage customers to tip and how they distribute all tips and service charges to their employees. This requirement ensures transparency and fairness in the handling of gratuities.

By establishing and documenting a clear, fair policy on tip distribution, employers can ensure that all employees are aware of how their tips are managed and distributed. This transparency helps maintain trust and fairness within the workplace, contributing to a positive working environment.

In many dining establishments, you may find that sharing tips between waiters is a common practice. The decision on whether to share tips among waiters can vary depending on the restaurant’s policy or the wait staff’s agreed-upon arrangements.

It is not typically common for waiters to share tips with kitchen staff, primarily because waiting staff often earn less and are potentially on the national minimum wage.

However, under the new Employment (Allocation of Tips) Act 2023, with the legal ownership of tips going entirely to the workers, there is now scope to formally include kitchen staff in the written tip policy as many argue they are a part of the chain of service. This change offers several benefits and reasons for extending tip sharing to the back-of-house team.

The concept of shared tipping is often embraced to foster a team-oriented environment, where the service provided to guests is seen as a collective effort. By pooling tips, you are contributing to a system that supports equity amongst the front-of-house staff, which may include not just waiters but also bussers and bartenders depending on the restaurant’s custom.

For more insights into the perspectives of waiters on tip sharing, Hospitality staff set to keep all their tips under rule change provides a glance at proposed changes and existing sentiments within the industry.

Sharing tips among staff can be managed through various structures, each designed to ensure fairness and reflect the contributions of each team member. The chosen method can range from simple to more complex systems, depending on the establishment’s preferences and operational needs.

Below are common methods used in the service and hospitality sectors:

In many UK establishments, the use of a Troncmaster is a popular method for tip distribution. A Troncmaster is an appointed person responsible for allocating tips to staff. This individual typically follows an agreed-upon system that may include factors such as the number of hours you have worked, your seniority level, and your specific job role within the restaurant.

The Troncmaster aims to ensure that tips are shared in a way that is perceived as fair by all employees, reflecting their contributions to the overall customer service experience. The appointed Troncmaster is also independent of the employer and does not have the power to hire or fire employees to help prevent any unfair distribution of tips.

In many hospitality establishments, seniority does not typically dictate the distribution of tips. Rather, a tip pooling system is often utilised where tips are shared among staff based on a pre-determined formula. This formula might consider several factors, such as hours worked or role responsibilities, to ensure a fair distribution.

For example:

Here’s a simple breakdown of how a tip pool might be split:

| Role | Percentage of Tips |

| Servers | 60% |

| Bartenders | 20% |

| Kitchen Staff | 10% |

| Support Staff | 10% |

This approach de-emphasises seniority in favour of a system that recognises the collective effort of the team. In some cases, an employee’s tenure may be considered when determining point allocation within the pool, but it is not the overriding factor.

You need to know that specific policies can vary between restaurants. You should be informed about your establishment’s method of tip sharing, as detailed in resources like Tip Pooling and Tip Splitting: The Complete Guide for restaurant owners.

Remember, if you work in an establishment that is transitioning to new rules on how tips are shared from 1 July 2024, you might notice changes to the tipping policy that will need to be clearly communicated, as advised by industry experts in articles such as How to share tips fairly and transparently.

In the hospitality industry, part-time staff are subject to the same tip-sharing rules as full-time staff. This means that part-time employees must share tips under the establishment’s tip policy, just like their full-time counterparts. There is no distinction in the application of these rules based on employment status.

Agency workers, similar to part-time and full-time staff, are also included in the tip-sharing arrangements. An “eligible agency worker” is defined as an individual who:

This ensures that agency workers are treated equitably and receive their fair share of tips under the same rules that apply to direct employees.

It is important to note that freelancers are not covered under the Employment (Allocation of Tips) Act 2023. Therefore, freelancers do not receive tips through the tip-sharing policy arrangement of the establishment. This distinction ensures clarity in who is eligible for tip sharing and prevents any misunderstandings regarding tip distribution.