Navigating the complexities of tipping laws can often feel overwhelming for both employers and employees in the service industry. With the introduction of the Employment (Allocation of Tips) Act 2023, many still have questions around: Who do tips really belong to?

This question is especially important as the new legislation marks a significant shift from past practices, where employers could legally claim ownership of tips. Understanding these changes is crucial for ensuring that tips go directly to those who earn them, without unfair deductions or mismanagement.

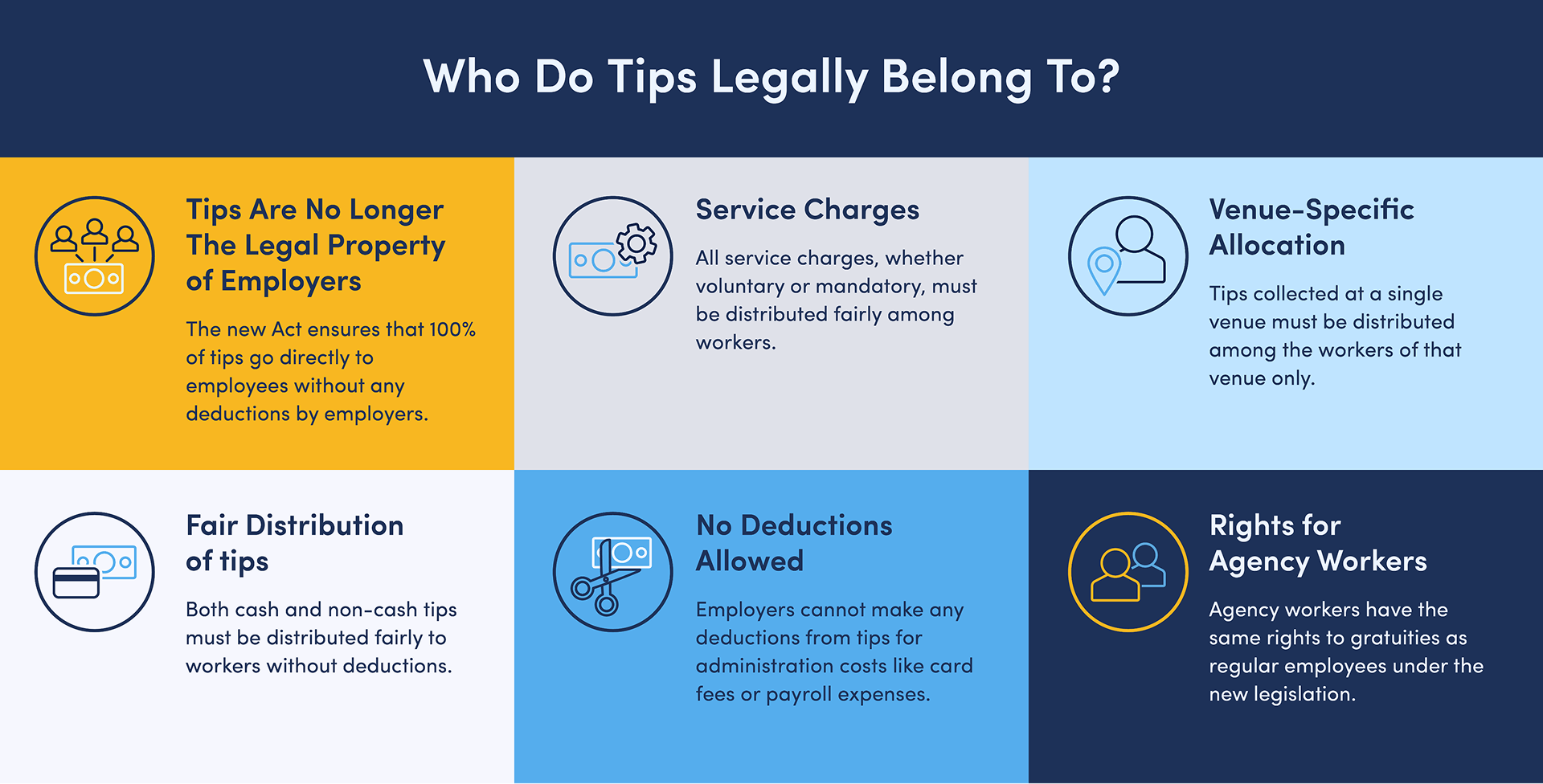

Under the Employment (Allocation of Tips) Act 2023, staff workers are entitled to 100% of the tips they earn, with no deductions made by their employer.

Previously, tips & gratuities paid to the employer were the legal property of the employer. This legal change ensures that tips go directly to staff.

Here is a quick overview of workers’ entitlement to tips:

Before the implementation of the new Act, in terms of legal ownership, all tips and service charges paid to the employer by debit card, credit card or cheque were the legal property of the employer.

The employer then had the discretion to distribute them as they saw fit. Some employers with improved tipping practices passed 100% of the tips to their employees, however, some employers would routinely make deductions from staff’s tips.

This was a concern for the public and those working in the hospitality sector, especially those who were working the national minimum wage. Additionally, these deductions from tips may have been used for several reasons including:

Typically, service charges are added to your bill either as a discretionary or mandatory amount. Regardless of the type, the service charges you pay are legally owed to the employees.

If a mandatory charge is applied to the receipt of the bill and is clearly stated then the consumer is required to pay this cost.

All types of service charges belong to employees without deductions. The Act also mentions that all services charge are qualifying service charges even if they are described as something else.

This is important if an employer decides to change the service charge to a “supplemental charge” to avoid paying staff their due tips.

The Act also does not differentiate between voluntary and mandatory service charges and as a result, no deductions are to be made by the employer.

Employers must distribute service charges to staff without making deductions, except those required by law, such as taxes. This means that the service charge or tips from customers is allocated directly to the staff members who provided the service.

It’s your right as a consumer to inquire how the service charges are allocated amongst the staff. Establishments should clearly inform you whether a service charge is discretionary or mandatory and provide information on how these charges are distributed.

Remember, when you are paying a service charge, you are directly contributing to the income of those who have served you and linked to the quality of service you received. Hence, these charges, voluntary or otherwise, are the legal earnings of the employees.

Employees may receive tips or gratuities in amounts that are not paid in money, for example, a gift or as a voucher. It’s important to understand that these gratuities belong to the employee.

The legal stance in the UK is clear: tips, whether cash or in the form of gift vouchers, are given directly to the service staff as an appreciation for their service and should not be withheld by the employer.

This covers any gift or voucher that has a fixed monetary value or can be exchanged for money or any goods or services.

The distribution and handling of tips are also subject to certain guidelines. For example, the government provides a Code of Best Practice on tips that employers can follow. They’re not legally bound to adhere to it, but it is considered good practice.

Workers of employment agencies hired to work at venues will have the same rights to tips as if they were regular employees:

You should be aware that the Employment (Allocation of Tips) Act 2023 has a wide-reaching impact across various service industries within the UK. This legislative change concerns England, Scotland, and Wales, and it specifically addresses how businesses manage and distribute tips, gratuities, and service charges.

The Act applies to sectors that traditionally collect tips and include, but are not limited to:

If you work within a restaurant or a pub, expect that the total tips you receive are now legally protected under the new Act.

For those offering beauty treatments or haircuts, similarly, your tips are rightfully yours, by law.

Moreover, while the ramifications primarily affect customer-facing roles, businesses that charge a service fee or any kind of discretionary or non-discretionary payment intended for employees are required to comply with the Act. This ensures that such additions to your payment as a worker are properly allocated to you and your colleagues.

Should your work involve handling service charges, a grasp of the specifics provided in the legislation is advantageous. You can view the full Employment (Allocation of Tips) Act here.

From 1 October 2024, there are certain requirements for businesses under the new legislation.

a. Fairness is relative and factors such as job role, length of employment, hours

worked, and seniority are all used by a business to interpret what is fair.

b. Employers can consult with staff to help determine what a fair tip policy is. It is best practice to consult with someone on their staff who does not have the power to hire and fire staff.

c. They may decide to include backroom staff who are not typically involved with the face-to-face service e.g. kitchen staff.

a. Although interpretations may vary from business to business, employers are

required to provide written policies that clearly describe how tips and service

charges will be distributed to staff.

It should include:

Tips, gratuities or service charges generated at one public place of business cannot be shared with workers at another public business. This ensures that the tips generated by the workers of one location based on their service is not shared with other workers at a different location which belongs to the employer.

This is particularly important for businesses that own multiple restaurants, chains or branches within the UK.

a. Pay staff and agency workers 100% of the tip without deductions in addition to

their wage

For example, if a worker was paid service charge on the 9th May, then the employer would need to distribute the tip to the worker no later than the 30th of June.

a. Qualifying Tips: The total amount of tips received at or attributable to their place of business.

b. Allocated Tips to Workers: The amount of tips that have been distributed to the employees directly or via an independent tronc operator.

Records must be kept for 3 years.

a. Workers can request access to their record of gratuities, for one month or two

consecutive months, but these months must have already passed.

As mentioned above, there are quite a few requirements for employers to ensure they are compliant with the new legislation from 1 October 2024.

This poses a few challenges as a lot of payments have moved onwards to electronic forms of payment e.g. via debit or credit card payments.

Employers should ensure they have the right technology that ensures their staff receive 100% of the tip under a fair tip policy but also store transaction details upon request with payroll reporting. This will reduce hours of administrative work, and admin costs and potentially save on tax costs.

With URocked’s card machine, all transactions are split between the business and the tips due to workers. This ensures legal compliance, reduces admin and pays your staff 100% of what they are owed in tips at the point of sale.

With the introduction of the Employment (Allocation of Tips) Act 2023, set to come into force on 1 October 2024, here are steps you should consider to ensure you are prepared:

Here’s a quick checklist to keep you on track:

By taking these proactive steps, you can be confident in your understanding of how the new legislation affects your earnings from tips.

In this section, you’ll find concise answers to common queries about the legalities of tipping in the workplace within the UK.

No, your employer cannot take money from your tips. The upcoming laws on staff tips mandate that tips should be given to staff without any deductions, except those required by law like taxes.

Legally, your boss is not allowed to keep your tips. All tips, whether paid by cash or card and regardless of their distribution method, are to be passed on to the staff, atop their regular wages.

Yes, it is considered illegal for employers to not share tips with their employees. There’s a Code of Best Practice on tips which, although not mandatory, lays out how employers should handle them and is aimed at ensuring fair distribution amongst staff.

Employees can take action if tips are unlawfully withheld. A worker may present a complaint to an employment tribunal and the circumstances in which the employment tribunal can consider this claim. If new tipping practice overhauls are in place, employees can also seek enforcement under these.

You may leave a gift card or voucher instead of a discretionary tip or service charge, however, this is not common. This may also inconvenience the worker as they may prefer the monetary amount and not necessarily want to obtain a gift from where the gift card is eligible. Leaving a gift card or voucher on top of the tip paid would be more acceptable if, for example, you received exceptional or quality service.